Feb 9, 2023

Over time, the demand for certainty and control is increasing among users. Now, everyone is familiar with cryptocurrency wallets- from those who have invested money using it to those who are only interested in understanding what it is. However, not everyone knows that not all cryptocurrency wallets are safe.

Blockchain transactions can easily be tracked and traced back to a person’s identity if they aren’t careful with their wallet choice. The more control we have over our assets, the more secure we feel as everything is in our hands; which is why a decentralized wallet has been introduced.

What Is a Decentralized Crypto Wallet?

A decentralized crypto wallet does not work on a single server, instead, it distributes the responsibility of storing cryptocurrency across multiple computers, which makes synchronization and security much stronger. These wallets store crypto assets and allow users to make diverse crypto transactions regardless of the Blockchain. The users can store, manage, access, and trade their digital assets with it. To access the Decentralized wallet, the user requires private keys, and the user himself is the owner of those private keys. Therefore, no third party can access the wallet except the potential user.

However, if users lose access to their private keys, they cannot recover the decentralized wallet, so make sure that you keep the backup of your private keys somewhere in a secure place.

Need For a Decentralized Wallet

The rise in blockchain-based cryptocurrency transactions has revolutionized the world of investment in recent years. By enabling individuals to take control of their finances and manage their money independently of centralized authority, cryptocurrency has given people the power to build their financial empires. A decentralized crypto wallet provides an easy and affordable solution for storing funds, accessing various exchange platforms for real-time token trading, and executing safe, low-risk transactions.

An Ideal Decentralized Wallet will allow you to

- Access DeFi Applications:

You can access the diverse DeFi applications using the decentralized crypto wallet like Compound Finance, Makerdao, and more.

- Trade Crypto:

Trade Crypto assets anytime from anywhere in the world.

- Lend Assets:

A user can lend assets and earn a profit using the DeFi wallet.

- Non-Custodial:

Decentralized wallets are non-custodial and provide complete control over your wallet and private keys.

- DeFi Assets:

Decentralized Wallets support almost every DeFi asset like USDC, DAI, ETH, and many more.

What are the benefits of using the Decentralized wallet?

These crypto DeFi wallets enable users to trade or transact in crypto without any central authority. Those involved in the transactions will only have control of it. Check out how crypto wallets can make your trading experience better.

- Security:

The decentralized wallets are accessed using the private keys controlled by the user. Therefore, no person from the outside world can access the wallet. Only users with private keys can control assets in the wallet.

- Compatibility:

Decentralized wallets can connect to the web3 wallet to send/receive crypto payments, and interact with Defi applications and smart contracts.

- Control:

All the assets in the crypto wallet are controlled by the user using their private keys. Any third party cannot access the wallet.

- Accessibility:

A user can access the Decentralized wallet from any location and anytime as they are globally accessible.

| Feature |

Custodial |

Non-Custodial |

| Control over private keys |

Centralized |

Decentralized |

| Security of funds |

Dependent on third-party |

Enhanced, locally stored |

| Accountability of loss of funds |

Centralized entity |

User is responsible |

| Ease of Use |

Less technical |

More technical |

| Compatibility with dApps |

Limited |

Full compatibility |

| Privacy |

Little to none |

Improved |

What is the future of a Decentralized wallet?

The more you explore the crypto world, the more quintessential your decentralized wallet will become. These wallets are self-custodial providing the user with complete ownership of their assets. Also, only the user will be responsible for managing and controlling their funds.

is no need for an intermediate for the transactions, and one can start dealing in a completely secure environment.

Decentralized Wallets support peer-to-peer transactions based on smart contracts. Such transactions bring a plethora of benefits to the table such as – independence, control, and security.

Using the Decentralized wallet to execute transactions can be a smart choice for both beginners and experienced people. Regardless of what changes come in the cryptocurrency in the future, you will always ensure that your assets are accessible and secure.

AnCrypto – The First Chat & Pay Decentralized Crypto Wallet

AnCrypto introduces the world’s first Chat & Pay Decentralized Crypto wallet. No sign-up or KYC is required! Being a decentralized wallet, AnCrypto does not ask users to share their private keys and personal information. So, without worrying about compromising any of these details, you can transact on any Blockchain with ease & convenience. Use AnCrypto decentralized crypto wallet to manage, store, access, buy, send, receive, and swap tokens across multiple Blockchains.

In addition, you can use the wallet to manage multiple crypto portfolios, explore decentralized applications, trade tokens, and check real-time crypto market updates.

What are you waiting for? Put your hands on the world’s first Chat & Pay decentralized crypto wallet now!

Feb 7, 2023

Just like in the physical world, a bridge helps to connect two roads or locations, and a Blockchain Bridge helps to connect the two Blockchain networks. The connection between the two Blockchain networks lets users transfer tokens or data from one Blockchain to another. But why do we need the Blockchain Bridge in the first place?

What are Blockchain Bridges?

Blockchain bridges are infrastructure that allows different blockchain networks to communicate and exchange data, assets, and information. They work by connecting two or more independent blockchain networks and enabling them to transfer information and assets between each other in a secure and transparent manner.

This helps to increase the interoperability of different blockchain networks and makes it easier for users to transfer assets and information across different platforms. Blockchain bridges can also help increase the scalability of decentralized networks and enhance overall security in the ecosystem.

What are the Benefits of Blockchain Bridges?

Different blockchains have their own smart contract rules, consensus policies, architecture, and token standards. This makes it complex to execute a transfer of assets between multiple blockchains.

Blockchain has certain limitations, and interoperability is one of them. Each Blockchain has its standards and set of rules that are not always compatible with other Blockchains, which is why cross-chain transfers are impossible.

For example, One can not run the Token of Bitcoin Blockchain on Solana Blockchain as both the Blockchain have different standards.

Therefore, Bridge is used for creating the synthetic derivatives for representing the various Blockchain assets.

- Increased interoperability:

Blockchain bridges allow different blockchain networks to communicate and exchange data, making it easier to transfer assets and information across different platforms.

- Improved user experience:

By enabling seamless transfers between different blockchain networks, blockchain bridges can help to improve the user experience for those who use multiple blockchains.

- Increased accessibility:

By making it easier for users to transfer assets between different blockchains, blockchain bridges can increase the accessibility of decentralized technologies for a wider range of users.

- Enhanced security:

By providing a secure and transparent method for data and

transfers between different blockchains, blockchain bridges can help to increase overall security in the decentralized ecosystem.

- Greater scalability:

Blockchain bridges can help to increase the scalability of decentralized networks by enabling the transfer of data and assets across multiple platforms, rather than having to process everything on a single chain.

Types of Blockchain Bridges

- Token Specific Bridge

Token-specific Bridge is a unidirectional bridge that enables users to move the token only in a single direction i.e from the source blockchain to the destination blockchain.

- Chain-Specific Bridge

Chain-specific bridges enable the users to transfer assets from/to a specific chain.

For example: Using the Terra Bridge, you can move assets from Terra Blockchain to another blockchain and vice-versa.

Chain-specific bridges are developed by a specific blockchain for cross-chain bridging from a particular blockchain to any other blockchain.

- Multi-chain/Multi-token Bridge

Multichain/Multitoken Bridge enables the users to move the tokens from one Blockchain network to the other. Some of the most popular Multi-chain/ Multi-token bridges are Multichain, Wormhole, ChainPort, and Allbridge.

All these bridges look the same, however, they follow different mechanisms and parameters like support for the number of Blockchain networks, tokens, security models, etc.

How does the Blockchain Bridge Work?

Suppose you want to transfer a Bitcoin to Ethereum. To do so, you need to deposit the Bitcoin onto the Blockchain Bridge.

The bridge will not lock your Bitcoin in a smart contract and mint the equivalent amount of Ethereum Blockchain. Blockchain bridge works upon the “ Burn and Mint” protocol; tokens are burned ( destroyed) on the source Blockchain and minted ( created) on the destination Blockchain.

When you make the Bitcoin transfer to Ethereum, the Blockchain Bridge will hold the Bitcoins, burn them, and create the equivalent in Ethereum. Here you need to note one thing; none of the cryptos are moving from one place to the other, instead, the amount you want to transfer is locked in the Smart Contract, and you get an equivalent amount of Ethereum.

And, if you want to convert the Ethereum back to Bitcoin, you will again use the bridge. Whatever is left will be burned and an equivalent wallet will be transferred to your wallet.

And, if you want to do the same without a bridge, you need to convert the Bitcoin to Ethereum on an exchange, withdraw the amount in your wallet, and again deposit it to the other exchange.

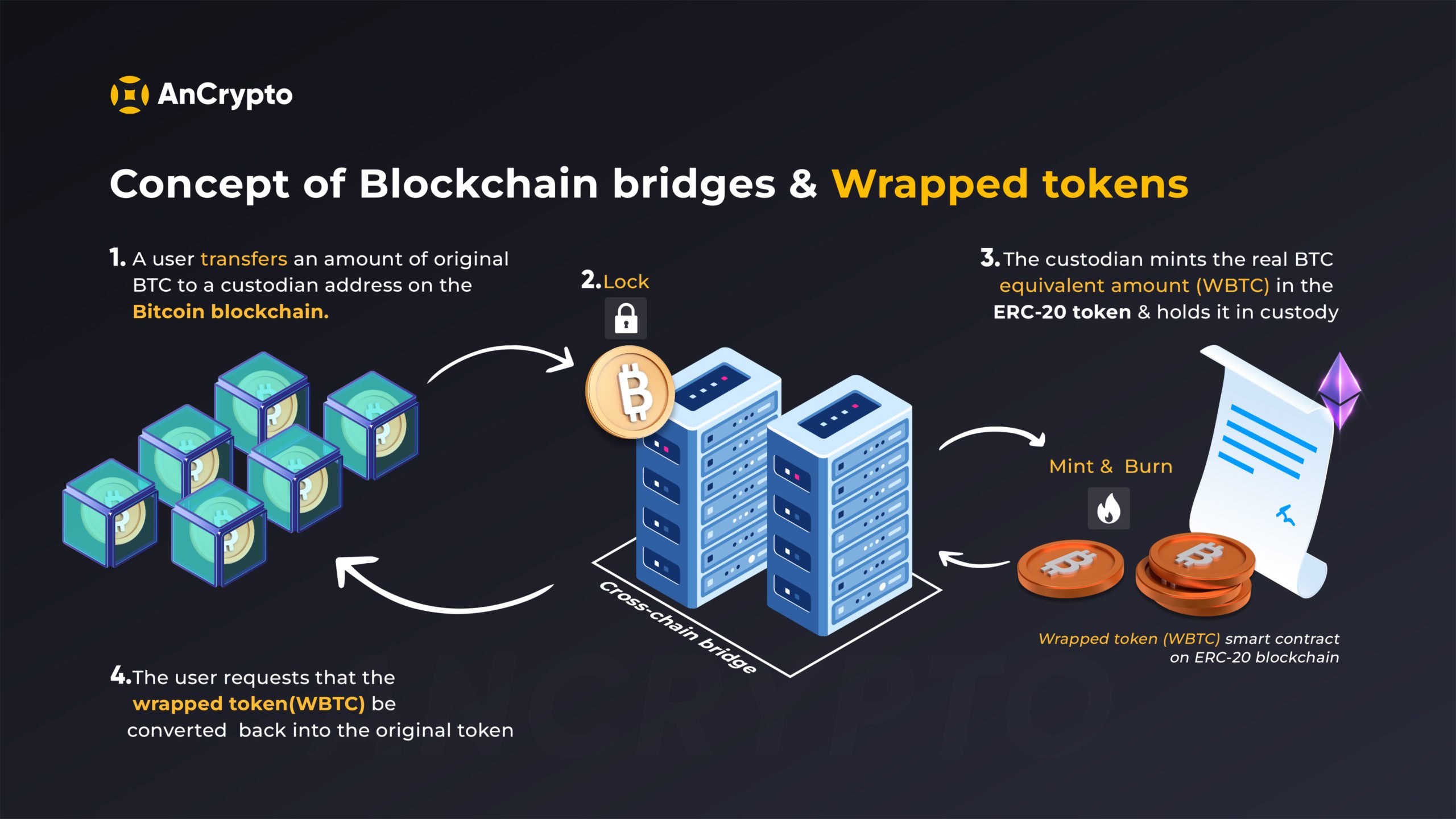

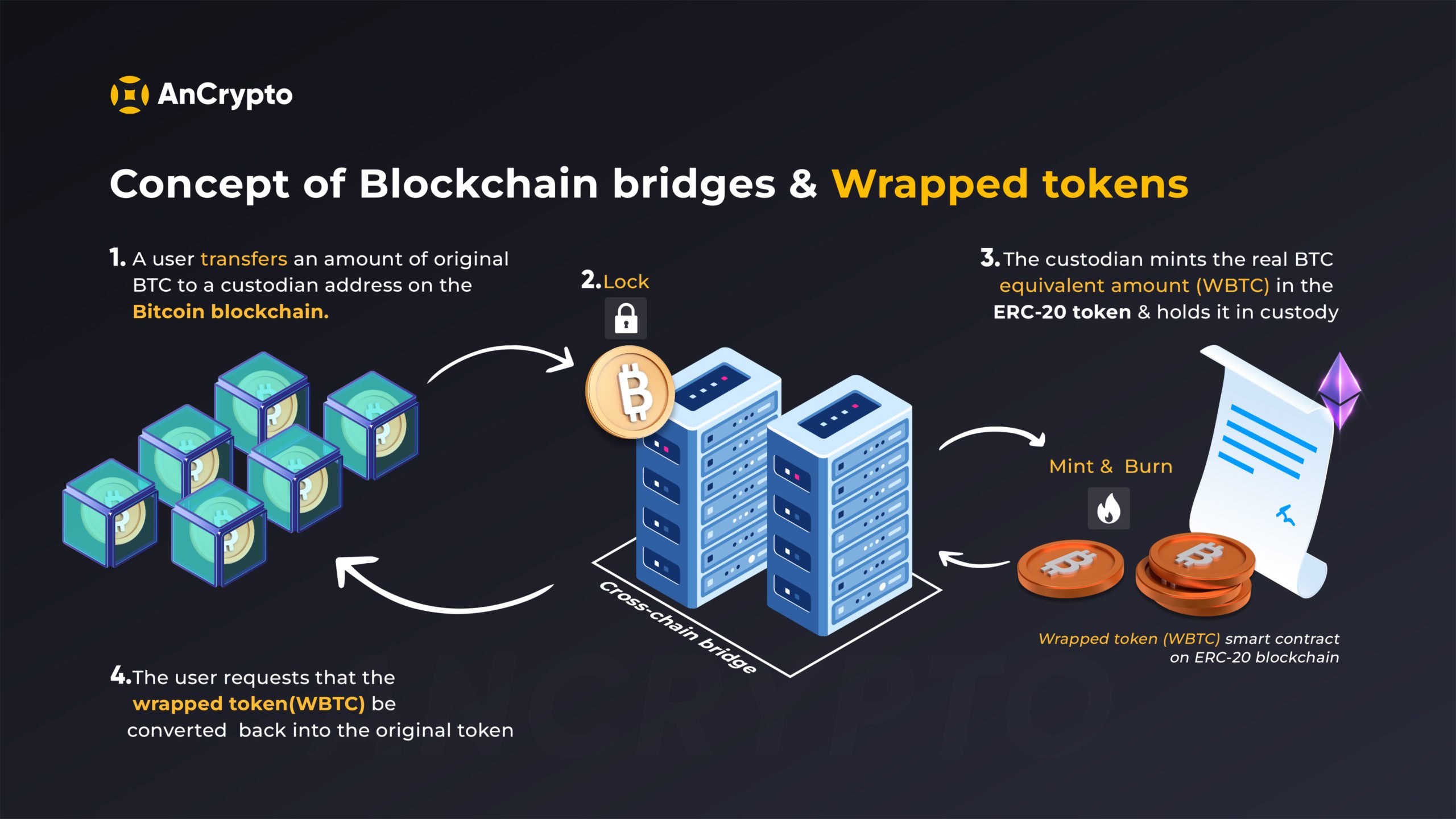

Blockchain Bridges and Wrapped Tokens

To better understand this, let’s first understand the concept of the wrapped token. A Wrapped token is a tokenized version of another crypto asset. This means, tokenizing an already existing currency or token.

Now, one simple example of bridges is the token transfers that we do in our wallets. If a user has to sell a token ‘A’, s/he can directly do it by swapping with another token ‘B’. For example, selling BTC worth 10 USD into ETH is achievable with simple taps on the screen.

However, this adds transaction costs while causing uncertain price volatility.

Let’s understand how a blockchain bridge resolves the gap. If you want to send 1 BTC to the Ethereum network, the bridge would lock the BTC and create an equivalent token in the ERC-20 standard known as wrapped BTC (WBTC). While the BTC is locked in the bridge smart contract, an equivalent amount is minted in the destination blockchain (Ethereum in this case).

This is just one use case of bridges. We discuss more later in the post. Meanwhile, here’s a quick run through the key benefits of blockchain bridges.

How AnCrypto is utilizing Bridges to Enhance User Experience?

In the pursuit of delivering a superlative cross-chain experience to the users, AnCrypto uses blockchain bridges. Bridges work as connectors to port assets from one blockchain to another bypassing the hassles of sluggish TPS and higher gas fees.

By enabling cross-chain transfers, AnCrypto users gain access to new protocols on other chains and leverage multi-environment features.

- Greater interoperability between networks.

- Enhanced liquidity enables cross-network asset trading.

- Allows users to benefit from different scaling solutions on each network.

- An added a layer of security to perform faster and safer transactions.

Currently, the decentralized wallet provides bridging among 3 chains – Ethereum, Polygon, and Binance Smart Chain. Going forward, the web3 ecosystem will extend bridging to more chains.

Future of Blockchain Bridges

Bridges have introduced interoperability in the Blockchain network, ultimately leading to mass adoption. You can see the exceptional growth in intra-blockchain transactions with bridges, and it has also reduced the transactional cost making it the preferable medium for Blockchain transfers.

Wrap Up

The Blockchain industry is growing and introducing innovations and bridges in one of those innovations. Bridges are helping the Blockchain ecosystems to become interoperable and cohesive which makes the entire Blockchain system better by removing network congestion. The future development of Blockchain bridges.